New models of industrial cooperation in materials recycling to strengthen the European circular economy

Successfully transitioning the European economy from a linear model to circularity is not only a technology matters but also an organisation and cooperation challenge. Beyond the “Cooperation is the new competition” mantra, the recycling industry is moving fast, developing industrial projects that interweave actors from the whole value chain to achieve raw materials circularity and contribute to the global decarbonisation of the European industry. These cooperation projects for example on products eco-design or closed loop recycling are keys for a greener European industry and for strengthening the European sovereignty. They need to be supported by an ambitious environmental and industrial policy and a strong European legal framework.

Paprec Group, one of the largest waste management operators in France and the leader in recycling, is an important player who participates in and supports the development of innovative projects aimed at enhancing circular value chains and European know-how in terms of materials recyclability.

Promising industrial partnership in closed loop for recycled plastic

Because the negative environmental impacts of the linear economy are questioning its licence to operate, the plastic industry is increasingly engaged into the transition toward circularity. Plastic recycling offers many opportunities for industrial cooperation and partnership. The value chains of plastics are evolving and reinventing themselves itself to meet the challenges of pollution and carbon emissions, reducing the use of fossil fuels and protecting the environment and human health. Manufacturers and plastics recyclers both stand to gain from sustainable and shared business models in terms of involvement and costs.

An early-mover of plastic circularity, Paprec has particularly invested in two ambitious industrial projects amongst others: closed-loop recycling of soft PVC flooring and bottle-to-bottle recycling of PET . In these two exemplary projects, the engagement of parties from different stages of the circular value chain – being it voluntary or pushed by the market or regulation – boost the effective and complete recyclability of the material.

By combining their industrial know-how, Paprec and Gerflor (an international champion of soft PVC flooring) created a common company, Floor to Floor. Floor to Floor aims at increasing the volumes of soft PVC flooring waste collected and recovered and the rates of incorporation of raw materials from recycling into the industrial loop with innovative tools. With more than 5,000 tonnes of PVC recycled into new floors each year, this successful partnership builds on the voluntary and continuous commitment of Gerflor to improve the design for recycling of its products and to purchase the recycled material at a cost-covering price. A new investment will soon bring the recycling and manufacturing plants closer together, this project has enabled the emergence of a virtuous and sustainable industrial model for soft PVC recycling.

In some occasions, recyclers are joining forces to develop an ambitious local industrial initiative, ahead of the value chain. A 75 M€ investment, France Plastiques Recyclage (FPR) is a joint company by the two main players in plastics recycling in France, Paprec and Suez. FPR is operated by Paprec who believed, back in 2009, that recycling was to become a must for plastics.

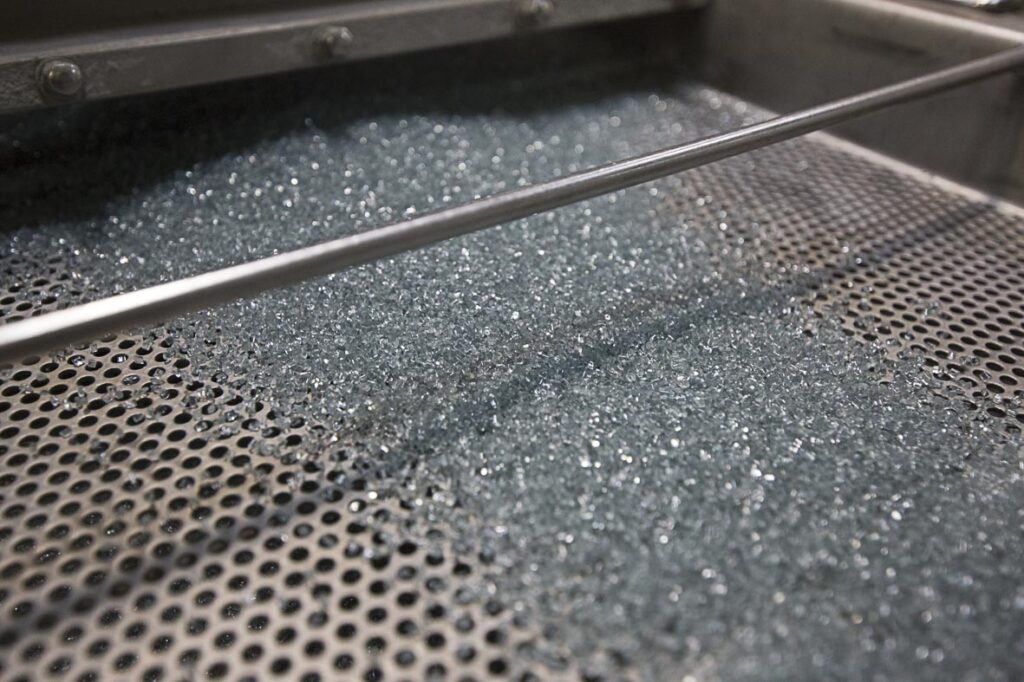

With best in class quality, the food-contact rPET pellets produced by FPR can be incorporated up to 100% in food-contact packaging, especially for bottle-to-bottle closed loop. Despite a decade of hard times due to low virgin plastics prices and unstable commitment of the value chain regarding recycled content, we confirmed our commitment for PET circularity.

The strong social demand for packaging circularity along with the regulatory push (SUP Directive) proved us right and instilled a strong cooperative dynamic within the PET packaging value-chain. After a new investment, the plant is now reaching over 50 000 t/y recycling capacity, equivalent to approximately 1,7 billion PET bottles per year.

Collaborative R&D work is carried out with customers and partners. The exchange of expertise on rPET properties and incorporation of recycled material are driven by the imperious need of offering flawless recycled PET for beverage bottles and other food containers. Reciprocal challenges between recyclers, packaging producers and brand owners are leading to better designed packaging and to more stringent quality procedures, for the benefits of the customers and the global value chain.

Cooperation in the value chain to foster recyclability and recycling: the new paradigm for the industry

Further upstream in the chain, consortium of companies to define criteria for the recyclability of plastic packaging are established at European level. This is the case of the the RecyClass project, a cross-industry initiative that brings together players in the value chain, not only the upstream but also downstream actors, to design common recyclability test methods and eco-design guidelines adapted to each polymer and packaging type. RecyClass also provides a scheme for recycling traceability as well as certification of recycled content into products. Recyclers such as Paprec are active members of this collaborative work on eco-design, which is essential to promote dialogue and process flexibility and, in the long run, to regulate the marketing of plastic packaging and substantiate recyclability claims.

Beyond plastics, this collaborative approach can be applied to other materials with equally – if not more – critical issues in terms of circularity, low-carbon industrial processes, but also regarding the industrial sovereignty and the supply of virgin raw materials for Europe.

In this regard, the management and recyclability of Waste from Electrical and Electronic Equipment (WEEE) is a industrial and environmental issue that needs to be tackled, particularly for the critical raw materials that these wastes contain. It requires efficient and innovative recycling technology and processes to successfully extract them. Better recycling of these materials, which can have a negative impact on the environment if not properly treated, is essential but calls for the development and re-industrialisation of the entire manufacturing chain so that the extracted recycled materials can find their way into new products in Europe.

Such cooperative projects are already being developed by the e-waste value chain which intend to reach industrial scale. For instance, Paprec is part of a consortium aiming at developing lithium-ion battery of electric vehicle recycling process. Collection and dismantling tests are carried out by the recycling party, providing the battery manufacturers with test materials for the concentration and the separation of metals, recovery of cobalt, nickel and lithium and, in fine, manufacture of cathode active materials. This type of project, which targets a high recovery rate around a complete hydrometallurgical system fits into circular economy development ambition and EU objectives in terms of management and self-sufficiency of critical raw materials

Along with brand and manufacturers, recycling operators are key contributors to make circularity a reality: their expertise covers not only the collection, sorting and dismantling of waste but also, as discussed earlier, the upstream design stages.

This industrial cooperation integrated into the entire value chain is essential and represents the project model that allows the development of an independent European industry, integrated into the environmental issues of end-of-life treatment of all products and materials and allowing the development of the European circular economy around the recycling of quality recycled raw materials. The new European Circular Economy Action Plan is a great opportunity to encourage these initiatives by creating the appropriate legal and financial framework for an integrated European-wide market for recycled materials, which is crucial both for the decarbonization of the European industry and the sovereignty in Europe.