Energy Trading – A European way of making our energy trilemma a reality

Across the fascinating insights in this series, you will read about the need to provide stable prices to electricity consumers; to boost the energy transition; to promote security of supply; and to ensure industrial competitiveness. You will have read less about the way to make those – often competing – policy goals a reality, or about the mechanism that has been allowing this for the past 25 years. So this article focusses on the way that the Internal Energy Market and efficient, well-regulated energy trading benefits citizens across Europe.

The Internal Energy Market is the perfect illustration of the benefits of a simple, European approach to complex questions. This market pools together all electricity production resources in the EU – by using the capacity of our networks efficiently – and allows all European consumers to access them on an equal footing.

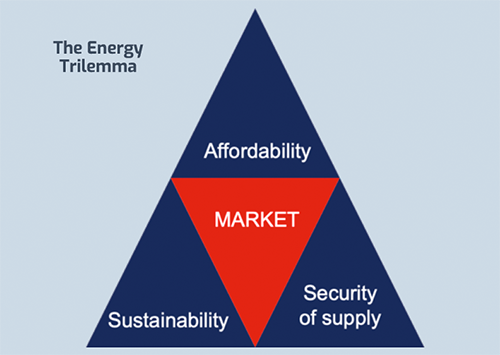

More prosaically, the market boils down to a single set of rules designed to find the economic optimum to produce and supply energy to European citizens. And this set of rules is bound by three overarching objectives: affordability, sustainability, and security of supply – the so-called “energy trilemma”. The market is the tool that balances these objectives. And with the right balance between them, it results in more competition in retail offers to consumers, a more stable system than can accommodate more renewables and a more attractive investment environment that guarantees our security of supply.

The Internal Energy Market comes to life through trading, i.e. when buyers and sellers of electricity come together. When many buyers and sellers do this in the same market, reliable prices emerge which benefit the system as a whole.

Trading is undertaken by all sorts of different actors: electricity producers; large industrials; retail suppliers buying on behalf of domestic consumers; and intermediaries that are neither producers or consumers. An intermediary’s role is to take some or all of the risks linked to the evolution of energy prices over time, which producers and consumers want to reduce or avoid altogether.

The added value of trading companies in relieving producers and consumers from financial risks over extended periods of time is best illustrated by an example: to provide fixed price contracts to domestic consumers, suppliers will need to secure a certain amount of energy at a stable price. They will therefore want to sign a forward contract to guarantee that price – with an intermediary taking and managing the risk of daily price fluctuations. This is what we call hedging, i.e. the continuous process of buying energy in advance – in 2019, 88% of EU electricity transactions were in forward markets – and reacting to any changes in events. This activity of covering risks long before the delivery of energy is at the heart of electricity trading. And it makes the overall energy system more stable and less volatile.

This is much more than a theoretical argument. The electricity market has been through a series of crisis over the past 25 years: the debt crisis the early 2010s; the Covid crisis in 2020; and of course, the energy price surge of 2022.

Through all these difficult times, the Internal Electricity Market contributed to keeping the lights on by allocating resources – sometimes scarce, sometimes over-abundant – as efficiently as possible. Europe has created a flexible and responsive system which adapts to changes at a moment’s notice – including by incentivising demand reduction when needed. Anything which can cope with a pandemic followed by energy crisis must have something going for it!

Trading can often be both maligned and misunderstood. Accusations of ‘speculation’ and ‘profiteering’ are often levelled at trading companies – despite, rightly, Europe having the most stringent set of rules of any liberalised energy market in the world. The reality is much different: compliance and risk management are the core business of any company trading power in Europe. While it’s undeniable that companies which are successful make money (and pay tax on that money), it is because they take on risks which not everyone is able to manage.

The views outlined in this note are perhaps not held by all politicians or consumers. This is obvious in calls by some to make radical interventions in the way the Internal Energy Market works.

However, the benefits of that market are well documented – EUR 34 billion savings in 2022 only says the Agency for the Cooperation of Energy Regulators. Surely, there will always be unknowns and there will always be challenges in delivering the energy trilemma in the years to come. But Europe’s Internal Electricity Market – the largest and best functioning of its kind in the world – is the best tool to adapt quickly and meet these challenges.

Which is why we must be careful not to undermine its effectiveness. If we move back to national approaches, if we introduce significant changes without sufficient analysis or if we fail to recognise the benefits of the system we have built collectively, then citizens across Europe will suffer. So our advice to policy makers considering the Union’s electricity market design is simple: do whatever you can to make the Internal Energy Market even more effective.