How to decarbonise and regionalise lithium production in Europe

A key conclusion that can be drawn from recent world events including COVID-19, COP26, or indeed Russia’s invasion of Ukraine, is that the EU needs to develop more resilient and independent supply chains for critical commodities from energy, pharmaceuticals, to microchips and battery metals.

Sovereign supply chains mostly involve building a local manufacturing industry, but this also needs to be done in a sustainable way and in line with CO2 emission targets. Lithium is a prime example of a critical material that Europe desperately needs, that should be produced locally and sustainably.

Lithium is a key and irreplaceable component in lithium-ion batteries which are then used in electric vehicles (EV) and renewable energy storage. It is a cornerstone resource of our efforts to mitigate climate change.

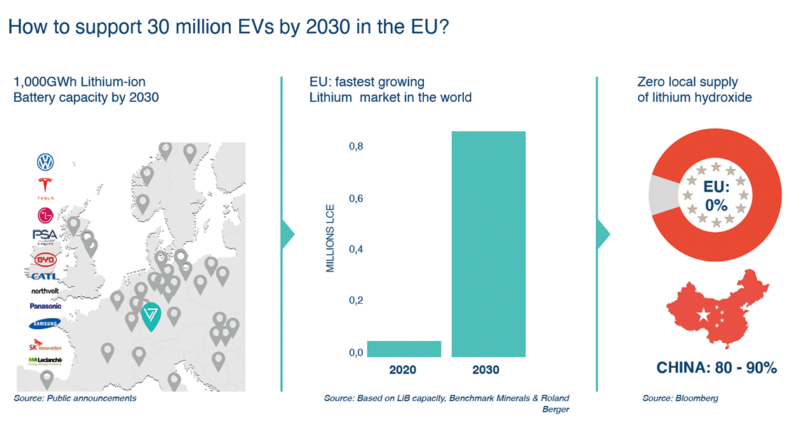

The lithium sector is undergoing tremendous growth. Global demand for the battery metal is expected to exceed six times its current size before 2030, mostly supported by the development of electric mobility. In Europe alone, it is estimated that we will consume around one million tons of lithium chemicals per year by 2030, a threefold increase on today’s global market. Lithium will be used in giga factories that are being or will be built across the continent, supported by companies such as Volkswagen, Renault, Stellantis, Tesla. Current projections show the European market will grow to be the second largest battery market in the world, after Asia.

Recently, lithium prices have experienced extreme upward pressure, increasing by more than 600% in less than a year. This surge is mostly due to the industry’s inability to increase supply fast enough to cope with the tremendous growth in the sector; and we are only at the beginning of the era of electric mobility.

Historically, lithium has mostly been extracted in Chile and Argentina, where a salty water was extracted from the ground and then stored in evaporation ponds. This is a lengthy process, consuming large quantities of water in some of the driest places on earth.

Today, lithium is extracted as a rock from open pit mines in Australia. The hard rock product is then exported to China, where it is refined into a lithium chemicals. Consequently, around 80 to 90% of the lithium used in our European EVs comes from China.

Currently, there is no lithium extraction or refining in Europe, meaning 100% of our lithium is imported. This is causing a number of concerns and complexities for European auto and battery makers, including logistical and geopolitical challenges, as well as environmental threat associated with the production of lithium itself. According to Minviro, a consulting firm based in London, specialising in Life Cycle Assessment, every ton of lithium hydroxide produced in China emits roughly 15 tons of CO2 emissions.

This is clearly not in line with automakers’ sustainability targets, nor is it consistent with what consumers are expecting when they purchase an EV. Driving a car with no exhaust emission is not enough; drivers also want to make sure the entire supply chain used for the vehicle, from when it is mined to when the rubber hits the road, is sustainable.

One logical solution to alleviate Europe’s reliance on China, and the associated environmental and geopolitical risks, is to start production lithium locally.

There are several lithium projects across the region, and many will need to be successful to supply the European market, but it is unlikely that there will be enough local production.

When developing a lithium project in Europe, there are many hurdles along the way including permitting, financing, environmental impact assessments and societal acceptance. Any mining project, in particular an open pit development, will face a challenging permitting process that requires a lot of experience and time.

The Serbian Government recently revoked approval for Rio Tinto’s Jadar project, an open-pit lithium mine. This is one example of how difficult it can be to build open pit developments in Europe, even if they are aimed at de-risking the European supply chain by offering a critical product such as lithium, locally.

The main element that needs to be addressed is the environmental impact of mining and refining activities, as this will have a great influence on the permitting process and on the societal acceptance of the project. Other challenges include the scale of some projects, where the size of the deposit doesn’t justify the construction of the refinery and requires feedstock to be imported once the deposit runs out.

Several European projects are looking at importing spodumene, a rock which contains lithium, in order to refine it into lithium chemicals.

This approach is similar to non-integrated lithium converters in China. However, there is an environmental concern because converting spodumene into lithium chemicals is energy intensive and can generate high levels of pollution. Further, the EU based converters would be importing spodumene containing 94% waste from overseas and the companies would then have to dispose of this unusable by-product on the European continent.

One European lithium project has been purposefully designed to alleviate these multiple issues. Vulcan Energy Resources is a German/Australian company aiming to become the world’s first integrated lithium and renewable energy producer with a net zero carbon footprint. Vulcan’s unique Zero Carbon Lithium™ Project aims to produce both renewable geothermal energy and lithium hydroxide for EVs, from the same deep brine source in the Upper Rhine Valley, Germany.

The company has secured access to the largest lithium resource in Europe. The resources which have been identified from just two of Vulcan’s eight licenses, spread across more than 1,000 square kilometres. There is therefore significant potential to increase the size of the resource and offer more sustainable lithium to the European market.

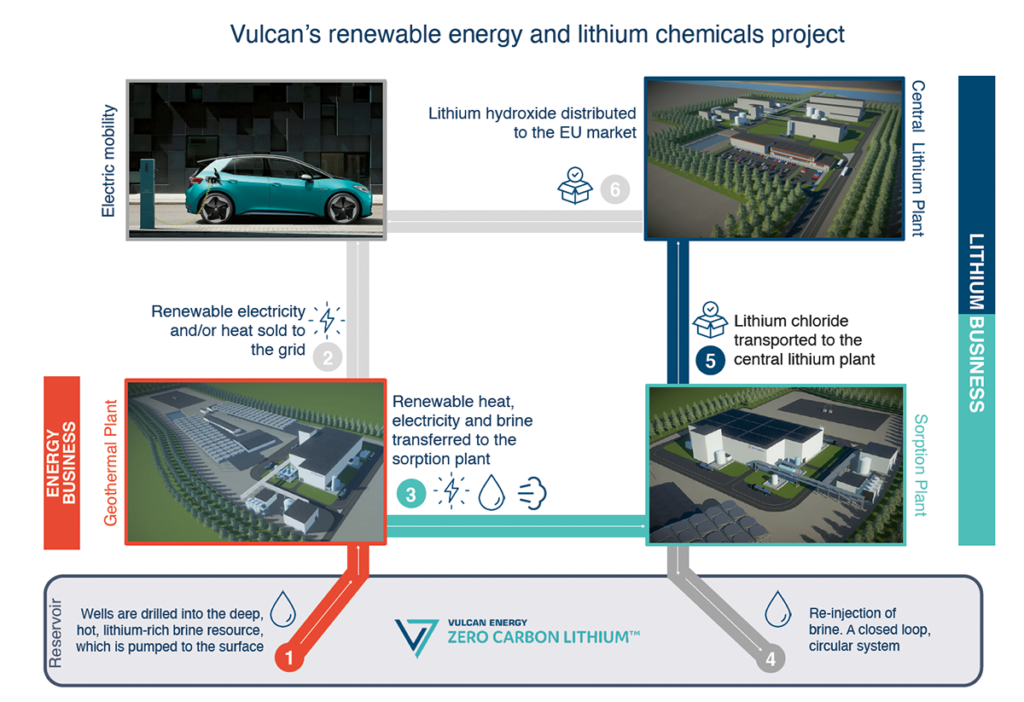

Lithium is found in the Upper Rhine Graben, dissolved in thermal water in underground reservoirs. Proprietary technology developed by Vulcan allows the lithium to be filtered from this thermal water, also known as brine, which has been pumped to the surface. Special sorbents are used to attract and extract the lithium ions from the brine. After the lithium is removed, the thermal water is returned to the natural reservoir in a closed loop system.

Extracting the lithium from the thermal water requires energy. Vulcan will use the energy from the heat of the thermal water, which can produce electricity and heat. The electricity can be used to power the pumps and other electricity needs of the geothermal system and lithium extraction, with excess energy sold to the grid. This makes lithium extraction climate-neutral, as no CO2 is emitted. Importantly, the process also consumes very little water and chemicals, generates a small amount of waste and will have a very small land footprint comparative to other lithium or renewable energy projects.

Vulcan’s Zero Carbon LithiumÔ Project started in 2018 and has rapidly advanced over a short period of time. The company, dual listed on the Australian and Frankfurt stock exchanges, has a market capitalisation of more than US$1Billion and has raised more than A$320M last year to finance the development of the project. Vulcan has also signed long term, binding lithium supply agreements with five key players including Volkswagen, Renault Group, Stellantis, Umicore and LG Energy Solution.

Currently, Vulcan is the only project in Europe with signed, long term supply contracts with European auto and battery markers and the only lithium project globally to have fully allocated its first 5 years of productions to non-Chinese tier one offtakers.

The company is currently operating a pilot plant for its lithium extraction process which is connected directly to a local geothermal plant. In late 2021, Vulcan acquired an existing geothermal operation and, since the beginning of the year, has been selling renewable energy to the German grid. A large demonstration plant will start operation in 2022, which is the last technical step before commercial construction and operation.

Vulcan is targeting phase one production in 2024, and will ramp up to produce enough output to supply more than one million electric vehicles per year. Following a significant capital investment to build the asset, the company hopes to expand and offer additional renewable energy and lithium to the European market, and work with the industry to de-risk and decarbonise the supply chain.