New EU corporate reporting standards could help companies become more circular – if done right

The promise and pitfalls of sustainability reporting: an overview

Sustainability reporting is a tool for companies to communicate their progress and plans for creating social and environmental value. It also creates accountability vis-a-vis stakeholders such as employees, investors, civil society, regulators, customers, etc.

Over the past decades, sustainability reporting has developed quickly as corporations increasingly accept that sustainability-related strategies are necessary to be competitive – from gaining business to attracting capital and employees.

Sustainability reporting is expected to create positive effects. First, it can enable better knowledge and management of the environmental impacts of companies. Second, it will be an incentive to improve companies’ sustainability performance as it will allow scrutiny by investors, policy-makers, consumers, and civil society.

However, sustainability reporting has not brought about the positive change it could. This is because the way companies measure and report their sustainability performance is nonstandard, incomplete, imprecise, and often misleading. As a result, information about sustainability performance is not useful to investors, governments, NGOs, or even to the companies themselves. A key solution to this problem is to standardise sustainability reporting to ensure the quality, comparability, and verification of sustainability disclosures.

The good news is that the EU has decided to go down this path. Brussels is in the process of standardising sustainability reporting. Under the revised Corporate Sustainability Reporting Directive (CSRD), the European Commission mandated the European Financial Reporting Expert Group to develop European Sustainability Reporting Standards (ESRS). The Commission is expected to adopt the first set of standards in the autumn of 2022. Eligible companies will have to track their 2023 activities according to the ESRS and will be expected to report them in 2024.

The rise of corporate circular economy reporting: the time is ripe

As an emerging sustainability topic, the European Commission has made the transition to a circular economy one of the key environmental objectives for sustainable finance, appearing in both the European Taxonomy Regulation and the CSRD. Its inclusion signals companies and investors that the circular economy agenda is here to stay and that investors are being encouraged to support companies in their transition.

However, since circular economy is the new kid in the bloc, there are no comprehensive and authoritative disclosure standards. As a result, circular economy content within sustainability reports is largely inconsistent and superficial. 1

ESRS requirements specific on circular economy can address this problem by creating a harmonised reporting system that produces quality, comparable, and useful circularity performance data. In turn, such requirements will encourage the development and management of corporate circular economy objectives and strategies.

The road ahead: getting it right

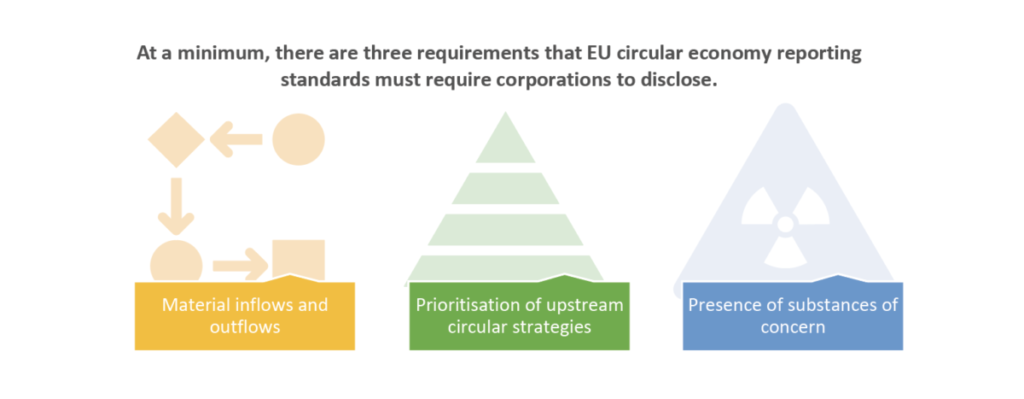

If done right, circular economy reporting standards present a unique opportunity for the EU to make a meaningful contribution to the transition to a circular economy. But what does it mean to get it right? At a minimum, we need three elements.

First, material inflows and outflows. Material inflows and outflows in circular economy reporting should be like scope 1 emissions (direct GHG emissions) in climate change reporting –a given. When it comes to resource use, the goal of the circular economy is twofold: reduce resource extraction and improve the efficiency and effectiveness of used resources. For companies to understand if they are reducing or improving their use of resources, they must keep track of both.

Inflows must capture the amount of material that enters a company, and whether materials are virgin, non-virgin, renewable, or non-renewable. Why? To decouple economic activity from natural resource extraction, in a circular economy, non-virgin resources are always prioritised over virgin resources, virgin non-renewable resources are avoided, and virgin renewable resources are always regeneratively grown.

Outflows must address two elements: design, and actual circulation or recovery. Design refers to a company’s capacity to devise products following circular economy principles. Circulation or recovery should show the undertaking’s ability to keep materials in the system.

Second, prioritisation of upstream circular strategies. A circular economy must prioritise strategies based on their ability to keep products at their highest utility level for the longest time. This means that upstream interventions (circular design, repair, etc.) should always be prioritised over downstream strategies (recycling, etc.). If companies fail to disclose how their outputs are circulated, we risk having organisations that rely only on recycling, calling themselves as circular as those that repair or refurbish.

Third, the presence of substances of concern. A toxic-free environment is a key principle of the circular economy, and one acknowledged widely for a simple reason: non-contaminated materials are easier to reuse and remanufacture. Thus, non-toxic products can have longer lifetimes. Moreover, non-contaminated renewable materials can be safely returned to the biosphere, whereas contaminated materials cannot. Therefore, it is crucial that organisations disclose the use of substances of concern and aim to produce toxic-free goods.

The circular economy is central to achieving the goals of the EU Green Deal. The new EU circular economy reporting standards will determine what type of information companies disclose, shaping circular economy reporting for years to come. If done right, circular economy information can improve company performance and be useful to EU institutions, investors, companies, and NGOs. If done wrong, corporate reporting will continue to be a box-ticking exercise – consuming the resources needed to drive real change in the mindsets of the corporate world. The choice to get it right rests in the hands of the European Commission.

1 – Opferkuch, K., Caeiro, S., Salomone, R., & Ramos,

T. B. (2022). Circular economy disclosure in corporate sustainability reports: The case of European companies in sustainability rankings. Sustainable Production and Consumption, 32, 436–456. https://doi.org/10.1016/j.spc.2022.05.003