Green finance to accelerate the circular economy in Europe

“Citeo’s ambition is to build a more sustainable world, thanks to the circular economy. Our mission is to find solutions for companies to exercise their Extended Producer Responsabilities and reduce the environmental impact of their packaging and paper. To achieve this, we are working together with all stakeholders, local authorities, recycling operators, industries, associations and citizens – on both the French and European scales”.

Citeo was set up in 2017 as the result of the merger of two organisations, one responsible for the Extended Producer Responsibility scheme for household packaging (Eco-Emballages, created in 1992) and the other in charge of graphic papers (Eco-folio, created in 2007).

28,000 companies have assigned Citeo the task of identifying solutions to reduce and design for recycling their packaging and papers, as well as efficiently organising their collection, sorting and recycling.

Our aim is to help our clients reach the target of 100% of packaging and papers reusable or recyclable by 2025; and to have all French consumers sort their packaging and papers on a daily basis. Consumer good companies are accelerating their move on environmental issues especially on the use of plastic – as a core element of their strategy. To accompany this movement and totally shift our economy towards environmental sustainability, the same transformation and acceleration is necessary for international banking and financing.

Last September, one day ahead of the UN Climate Action Summit in New-York, 130 banks from 49 countries, holding more than 47 trillion dollars in assets launched ‘The Principles for Responsible Banking’. Backed by the United Nations, one-third of the global banking sector commits to “strategically align [their] business with the goals of the Paris Agreement on Climate Change and the U.N. Sustainable Development Goals” in addition to “massively scale up their contribution to the achievement of both.” This commitment shows an attempt from businesses to initiate the ultimate shift towards sustainable development and circular economy on a global scale.

At the European level, effective incentives for low carbon investment can be generated by creating a solid and credible long-term vision for decarbonisation and an appropriate investment framework. This framework should recognise the complementarity between climate change and circular economy policies and must integrate a set of policies and financial instruments to close the loop of circular economy.

Such a framework also needs to be based on a long-term vision and overall policy objectives, pursuing a sustainable and equitable low-carbon economy. Better integrated, harmonised and synergetic climate and energy policies need to be designed to implement such a framework, which will provide the required long-term investment signals. Circular economy policies need to be better integrated with education, R&D, innovation and industrial policies, through a cross-sectoral vision of materials’ circularity. Enhanced sustainable financial solutions for low-carbon investment should be streamlined, reinforced and upscaled, both in the area of public funding and private finance, valuing public-private partnerships and blending.

Supporting sustainable finance to move forward for the circular economy

Sustainability is broadly recognised as the model for Europe’s future development, and finance is an essential leverage for achieving the ambitious goals of economic prosperity, social inclusion and environmental regeneration.

The Commission’s Action Plan on Sustainable Finance aims at enabling inclusive growth, by funding the society’s long-term needs for innovation and infrastructure and accelerating the shift to a resource efficient and low-carbon economy. European efforts in this direction are supported by a series of existing international frameworks and practices, which allow companies to efficiently contribute to limit climate change and to choose appropriate financial tools to support their sustainable model.

The Commission has presented a proposal for a Regulation for “Creating a common language for sustainable finance” to define what is sustainable and identify areas in which sustainable investments can have the most impact. This regulation applies to financial market participants offering financial products defined as eco-sustainable investments or those with similar characteristics in the EU.

The sustainable finance framework, currently being developed by the European Commission following the adoption of an ambitious action plan, will have to incentivise sustainable economic activities, without penalising those that do not fall within the aforementioned classification. Therefore, in identifying the criteria for sustainable finance, it is necessary to:

-

- maintain a holistic approach, by considering socio-economic elements and a gradual approach to guarantee an adequate low carbon transition;

-

- promote zero-carbon and low-carbon technologies while considering the entire value chain and emissions reduction schemes based on life cycle assessment (LCA) for products and packaging;

-

- enhance the commitment to the Circular Economy by promoting the internal secondary raw materials market;

-

- promote the inclusion of environmental, social and corporate governance factors in investment decisions of institutional and private investors as well as within the credit assessment of rating agencies;

-

- include a green finance approach for firms within a specific status of “company with mission” – new forms of commercial (for-profit) companies that define themselves statutorily, in addition to the profit-making purpose, a social or environmental purpose; as it is the case for Extender Producer Responsibility organisation for household packaging and graphic papers, Citeo is leading the way for the adoption of this new form with a specific environmental and social purpose;

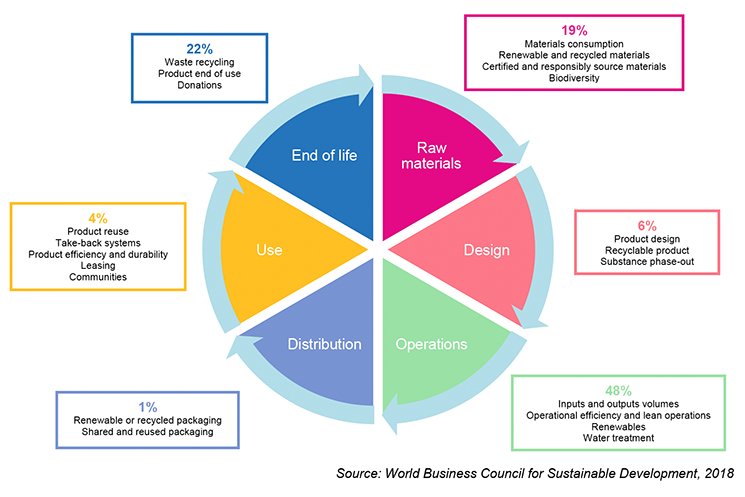

- promote circular metrics for circular approaches of companies, especially for packaging – that represented only 1% of circularity metric used by companies for 2017-2018 (source: World Business Council for Sustainable Development, 2018).

Overview of circularity metrics used by companies, 2017-2018

Implementing a coherent taxonomy & Multi-Financial Framework with a coherent institutional architecture to close the loop of circular economy

The future taxonomy will have to incentivise sustainable economic activities, without penalising others. A strong industrial base is a prerequisite for achieving a circular economy and decarbonisation of the EU, as drivers for innovation and growth. Vulnerable industries must be protected by a WTO-compatible carbon border mechanism to ensure they can compete on equal terms while promoting the circularity of materials and the competitivity between virgin and recycled material within the internal market.

Furthermore, the current negotiations on the Multi Financial Framework (MFF) with the proposal regarding a national contribution based on the quantity of non-recycled plastic packaging waste generated in each Member State could be an economic incentive to decrease the use of non-recyclable plastics. However, such a contribution will not be exclusively linked to any expenditures or investment in existing national plastic waste management systems. In this perspective, the EU needs to support new recycling schemes and facilities for plastics waste while promoting new alternatives to plastics.

Last July, EIB and EU’s top five banks have jointly committed 10 billion euros over the next five years to financing circular economy; such funds must be targeted for the circularity of plastics by facilitating circular strategies in all lifecycle phases of this material, linked with the green deal that Frans Timmermans will manage as Vice-President of the European commission.

Circular public procurement a complementary tool to accelerate the transition to a circular economy

Public procurement makes up for a significant part of the European economy, accounting for 16% of GDP (1,800 billion euros). This economic weight must be used to develop innovations to foster the circular economy and to push economic stakeholders to change their model. The European Directive 2014/24/EU of February 26, 2014 has already opened new possibilities for integrating environmental issues and circular economy into public procurement. However, public purchasers still lack simplified operational tools to effectively integrate circular economy aspects into their demands.

Therefore, the development of harmonised tools at the European level, in terms of both circular economy criteria and life cycle analysis is highly desirable (such as minimising waste, reusing waste within the organisation, improving design for maintenance, repair or reuse, selling scrap materials to other organisations). In addition, it is necessary to introduce binding targets to achieve circular models in the coming years.

Citeo’s recommendations for the next European Commission regarding green funds and taxonomy framework to close the loop of circular economy:

-

- Adopting a dynamic and phased approach to measure the impact of economic activities, to stimulate circular investments and to transition from a linear to a fully circular economy;

-

- Prioritising sectors that are expected to have the highest impact on the transition toward circular economy;

-

- Establishing an EU-wide classification system to help investors identify which economic activities can be considered environmentally sustainable;

-

- Measuring the impact of investments on circular economy activities at the EU level;

-

- Promoting the circularity of materials in all lifecycle phases at the European scale, with specific funds programmes from the EIB;

-

- Promoting the competitivity between virgin and recycled material within the internal market;

- Supporting new recycling schemes and facilities for plastics waste while promoting new alternatives to plastics.