PPP initiatives in the context of the European Energy Union

A powerful element for a sustainable energy system

Just a few days ago, on November 24th, the third state of the Energy Union communication has been presented while in parallel the biggest legislative framework change in Europe ́s Energy system is already underway with the Clean Energy Package being nego- tiated.

While the European Parliament and Council are now in the midst of their legislative work on the European Commissions proposals, discussions on the next Multiannual Financial Framework and the successor of Horizon 2020 the FP9 are already on many policy maker ́s minds.

The challenges in the energy sector that lie ahead are time-sensitive and complex in their nature and will require a high degree of innovation and investment both from public and private sectors stakeholders.

With very ambitious energy and climate action plans being put in place, Member States will have to dedicate to a careful and well-thought-out, market-based implementation of these.

In order to reduce dependency on energy-imports and make better use of renewable energy sources, investment into infrastructure capacity and smart energy solutions have to be facilitated.

This however, will not just pertain to fields like electricity generation, but also innovative solutions in the field of energy storage, demand response systems, interconnectors between Member States, smart energy management in transportation and a deeper market integration of renewable energy sources and in-between Member States.

It is therefore a more than suitable time to talk about the state and potential of public-private-partnerships in the context of Europe ́s Energy future.

According to the European Investment Bank, the aggregated value of European PPP transactions across all sectors totalled € 12 billion in 20161, a 22% decrease in comparison to 2015.

Nevertheless, the total number of 69 transactions reaching financial close has been significantly higher than in the previous year. While the number of PPPs in the energy sector that reached financial close has been relatively low in the last couple of years their potential in this sector is certainly high.

PPPs can be an advantageous vehicle in particular for investment intensive projects due to the possibility of resource and risk pooling and a market oriented alternative to subsidy based financing of new technologies.

Additionally, the collaboration between the public, industry and research organisations bears a huge potential for more efficiently distributing and leveraging on knowhow and skills stored in these `knowledge silos ́.

A more decentralized energy system will make it necessary to better identify such `knowledge-silos ́ and interconnect them via `knowledge pipes ́ on an European level.

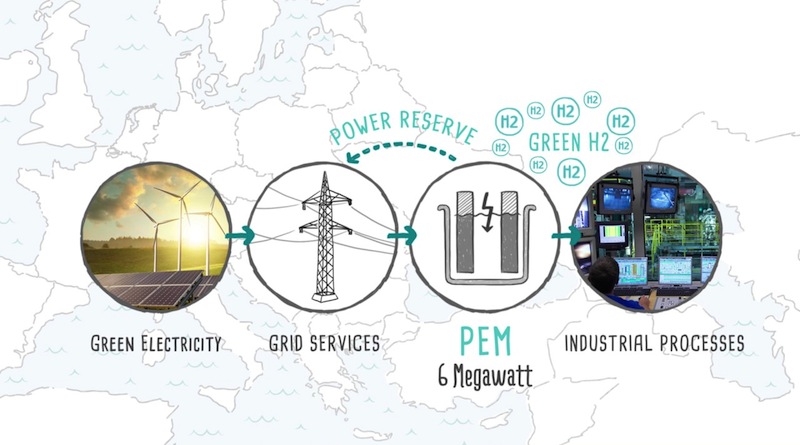

One of the latest and most promising PPP additions under the Fuel Cell and Hydrogen Joint Undertaking (FCH JTI) is the H2Future project in Austria, an example of green hydrogen production by using green electricity.

The project, with an investment volume of 18 million Euros has been announced in early 2017 and is being carried by four industrial and two research partners supported by the FCH JTI.

Its goal is to create hydrogen for a wide spectrum of use cases in what is planned to be the world ́s largest electrolysis facility.

The required electricity will be sourced from renewable power generation and the facility ́s output of 6 megawatt in hydrogen is to be utilized as industrial resource and for demand-response capabilities in the energy market.

In the long run it could potentially enable CO2 free steel production in Austria. This PPP could serve as a powerful example for many other future projects in the energy sector.

While SMEs participation in PPPs is still relatively low but could be enhanced, as their potential should not be underestimated! Due to their focussed know-how, high degree of specialisation and innovativeness, the participation of SME in PPPs can be of great added value for PPPs.

This potential is particularly heightened with energy systems becoming increasingly decentralised, context and region specific.

According to a report by the EIB from November 2016 however, several hurdles still exist, which have to be addressed in order to increase the likelihood for an increase in the number and volume of successful PPP investments.

Among others legal and regulatory frameworks should be better informed by experiences from existing PPP markets and need improvement with respect to reducing excessive restrictions.

Equally, approval processes need to be defined more clearly and efficiently. Moreover, due to the complexity of PPPs at all stages, capacity building for public and private sector stakeholders is a crucial factor.

Consequentially the exchange of best practices and other know-how across projects and markets should be facilitated. The ex-ante assessment of large infrastructure projects as lately suggested by the European Commission could be a very effective mechanism to that end.

While the most recent reform on European public procurement legislation in 2014 also included measures aiming at increasing the participation of SME, its implementation into national law has been slow and its impact will now have to be closely monitored.

Their contribution as part of PPPs could become an integral element of a successful a sustainable European Energy Union.